City of Central Falls, City Clerk

Public Notices

Ad textCity of Central Falls, City Clerk CITY OF CENTRAL FALLS

NOTICE OF PROPOSED PROPERTY TAX RATE CHANGE

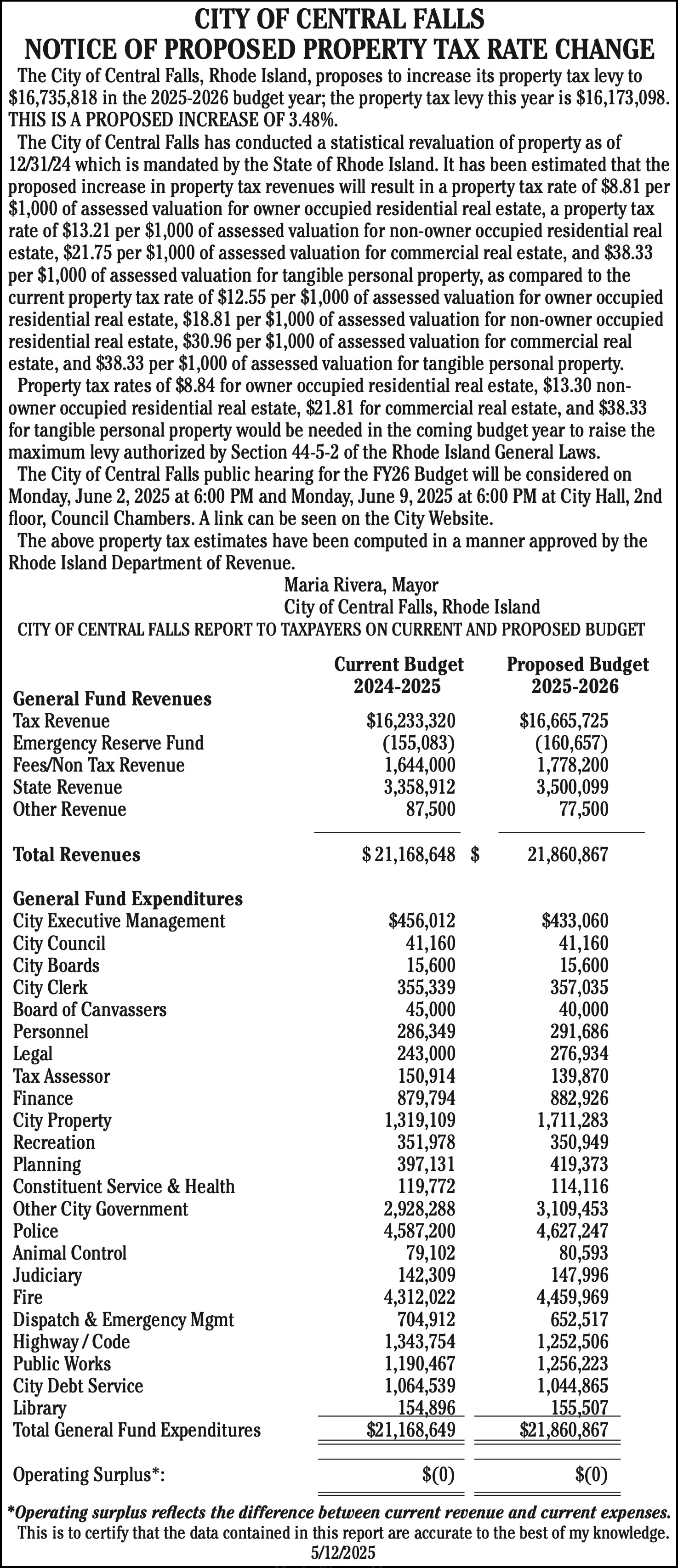

The City of Central Falls, Rhode Island, proposes to increase its property tax levy to $16,735,818 in the 2025-2026 budget year; the property tax levy this year is $16,173,098. THIS IS A PROPOSED INCREASE OF 3.48%.

The City of Central Falls has conducted a statistical revaluation of property as of 12/31/24 which is mandated by the State of Rhode Island. It has been estimated that the proposed increase in property tax revenues will result in a property tax rate of $8.81 per $1,000 of assessed valuation for owner occupied residential real estate, a property tax rate of $13.21 per $1,000 of assessed valuation for non-owner occupied residential real estate, $21.75 per $1,000 of assessed valuation for commercial real estate, and $38.33 per $1,000 of assessed valuation for tangible personal property, as compared to the current property tax rate of $12.55 per $1,000 of assessed valuation for owner occupied residential real estate, $18.81 per $1,000 of assessed valuation for non-owner occupied residential real estate, $30.96 per $1,000 of assessed valuation for commercial real estate, and $38.33 per $1,000 of assessed valuation for tangible personal property.

Property tax rates of $8.84 for owner occupied residential real estate, $13.30 non- owner occupied residential real estate, $21.81 for commercial real estate, and $38.33 for tangible personal property would be needed in the coming budget year to raise the maximum levy authorized by Section 44-5-2 of the Rhode Island General Laws.

The City of Central Falls public hearing for the FY26 Budget will be considered on Monday, June 2, 2025 at 6:00 PM and Monday, June 9, 2025 at 6:00 PM at City Hall, 2nd floor, Council Chambers. A link can be seen on the City Website.

The above property tax estimates have been computed in a manner approved by the Rhode Island Department of Revenue.

Maria Rivera, Mayor

City of Central Falls, Rhode Island

CITY OF CENTRAL FALLS REPORT TO TAXPAYERS ON CURRENT AND PROPOSED BUDGET

General Fund Revenues

Tax Revenue

Emergency Reserve Fund Fees/Non Tax Revenue State Revenue

Other Revenue

Total Revenues

General Fund Expenditures

City Executive Management City Council

City Boards

City Clerk

Current Budget 2024-2025

$16,233,320 (155,083) 1,644,000 3,358,912 87,500

$ 21,168,648

$

Proposed Budget 2025-2026

$16,665,725 (160,657) 1,778,200 3,500,099 77,500

21,860,867

$433,060 41,160 15,600 357,035 40,000 291,686 276,934 139,870 882,926 1,711,283 350,949 419,373 114,116 3,109,453 4,627,247 80,593 147,996 4,459,969 652,517 1,252,506 1,256,223 1,044,865 155,507 $21,860,867

$(0)

$456,012 41,160 15,600 355,339 45,000 Personnel 286,349 Legal 243,000

Board of Canvassers

Tax Assessor

Finance

City Property

Recreation

Planning

Constituent Service & Health Other City Government Police

Animal Control

Judiciary

Fire

Dispatch & Emergency Mgmt Highway / Code

Public Works

City Debt Service

Library

Total General Fund Expenditures

Operating Surplus*:

150,914

879,794 1,319,109 351,978 397,131 119,772 2,928,288 4,587,200 79,102 142,309 4,312,022 704,912 1,343,754 1,190,467 1,064,539 154,896 $21,168,649

$(0)

*Operating surplus reflects the difference between current revenue and current expenses.

This is to certify that the data contained in this report are accurate to the best of my knowledge. 5/12/2025

Maria Rivera, Mayor